26+ mortgage insurance on fha

The FHA mortgage insurance program offers protection for FHA and non-FHA home loans for up to 965 of a homes value. Web FHA loans require you to pay for mortgage insurance when you buy or refinance a home regardless of the amount of your down payment or home equity.

Fha Mortgage Insurance Guide Bankrate

Web The upfront mortgage insurance premium costs 175 of your loan amount and is due at closing.

. Mortgage insurance is another variable to consider when looking at FHA vs. FHA loans have a one-time upfront fee you need to pay at closing called UFMIP as well as monthly insurance payments called MIP. Web Understanding Mortgage Insurance Premiums in FHA-Insured Loans.

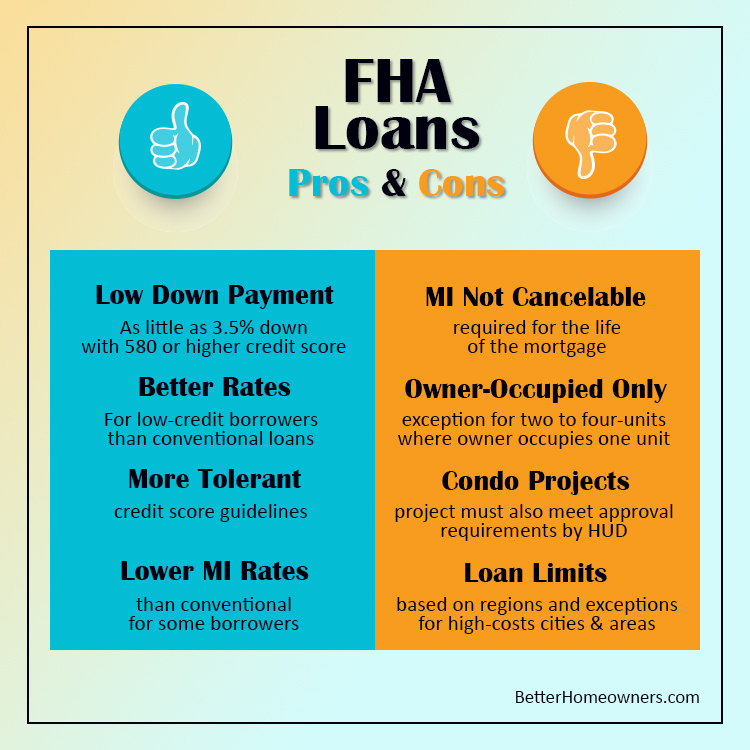

This allows a qualified homebuyer to make a down payment as little as 35 while protecting the lender in case of foreclosure. Once you reach 22 equity in your home a conventional mortgage lender automatically cancels your PMI. Web Today the Federal Housing Administration FHA published Mortgagee Letter ML 2023-04 Electronic Filing of all insurance claims on FHA Title II Single Family Mortgages.

The ML eliminates paper-based filings and informs mortgagees of the digital claim submission options for all insurance benefit claims on FHA single family forward mortgages. The initial FHA mortgage insurance cost is 175 of the loan amount. Web Someone with a 250000 FHA loan can expect to pay about 30000 in mortgage insurance premiums over the life of the loan.

Loans insured by the FHA allow borrowers to get loans with a down payment as low as 35 of the purchase price and a credit score of 580. Web The Federal Housing Administration FHA insures the most common type of reverse mortgage known as a home equity conversion mortgage HECM. Others will need to refinance into another type of loan to eliminate this extra monthly expense.

Sales Price 200000. This cost can be paid at settlement or financed with the FHA loan. Web HUDs preview of its final rule for the Housing Opportunity Through Modernization Act HOTMA delivers important benefits to residents participating in HUD assisted housing programs including Multifamily project-based assistance programs.

Web FHA mortgage insurance comes with two payment options for premiums. Depending on the loan amount and down payment a private mortgage insurance PMI premium may be applied with a conventional mortgage. Certain instances such as when the down payment is less than 20 require.

Web Mortgage insurance is a policy that protects lenders against losses that result from defaults on home mortgages. Federal Housing Administration FHA loans also require mortgage insurance. FHA mortgage insurance protects against the risk that you default or stop making payments on your FHA loan.

HECMs are offered only through FHA-approved lenders. Web There are two components to FHA mortgage insurance. If youre borrowing 250000 for example your upfront MIP will be 4375 250000 x 175 4375.

Web Heres an example of how to calculate the upfront mortgage insurance premium. The 175 UFMIP applies to most FHA loans no matter the loan amount or term except for the following. FHA mortgage insurance includes both an upfront cost paid as part of your closing costs and a monthly cost included in your monthly payment.

Web FHA borrowers are required to pay two mortgage insurance premiums. Most lenders require private mortgage insurance PMI for conventional loans when the home buyer makes a down. Web Homebuyers can apply FHA insured mortgages to new home purchases or refinances.

Todays FHA lenders no longer cancel your MIP once you reach a certain home equity percentage. First theres an upfront mortgage insurance premium of 175 of the total loan amount. Web What is an FHA mortgage insurance premium MIP.

Web Mortgage insurance protects lenders from losing money if you default on the loan. One upfront at closing and another annually for as long as you repay the loan in most cases. Take the sales price and subtract the down payment.

Some FHA borrowers can get rid of their monthly mortgage insurance premiums. If you take out a typical 30-year mortgage or anything greater than 15 years. So if you borrowed 150000 youd be required to pay.

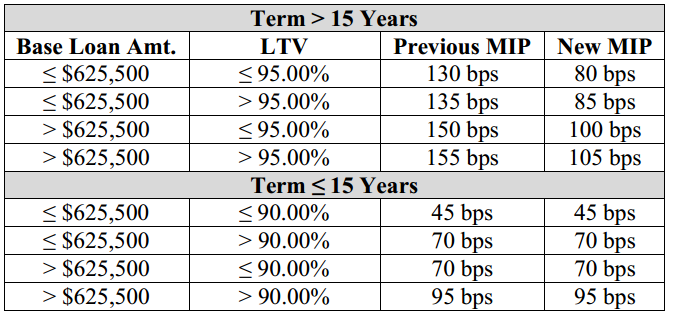

You are also required to pay for two kinds of mortgage insurance. FHA loans require a borrower to pay two. Web FHA loans with terms of 15 years or less qualify for reduced MIP as low as 045 annually.

2023 MIP Rates for FHA Loans Over 15 Years. Web Mortgage insurance. In addition there is the upfront mortgage insurance premium UFMIP required for FHA loans equal to 1.

These options depend on your down payment and other factors see below and youll have to choose between paying an upfront premium in full at closing or financing it. It costs the same no matter your credit score with only a slight increase in price for down payments less than five percent. Web FHA mortgage insurance is required for all FHA loans.

FHA requires both upfront and annual mortgage insurance for all borrowers regardless of the amount of down payment. One has you pay the insurance for 11 years and the other has you pay for the full duration of the FHA loan. Web Before 2013 MIP worked similarly to the private mortgage insurance PMI that you pay on conventional loans.

The amount of time youll.

How Can The Fha Know That I Don T Live In A Property I Have A Mortgage On Quora

Fha Requirements Mortgage Insurance For 2023

Fha Mortgage Insurance For 2023 Estimate And Chart Fha Lenders

Lindacrouse Lindacrouse Twitter

Fha Mortgage Insurance Premiums Guidelines On Fha Loans

Fha Mortgage Insurance Who Needs It And How Much It Costs Forbes Advisor

What Is Mip Mortgage Insurance Premium

Fha Mortgage Insurance Guide Bankrate

How Long Do You Pay Mortgage Insurance On An Fha Loan Budgeting Money The Nest

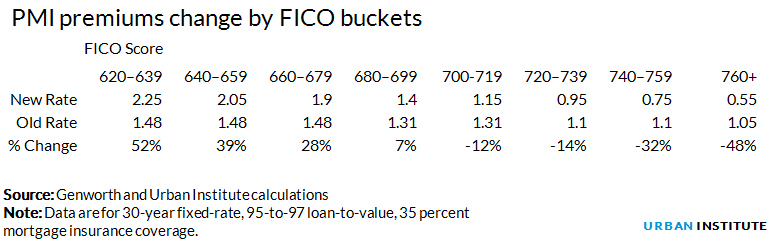

The Private Mortgage Insurance Price Reduction Will Pull High Quality Borrowers From Fha Urban Institute

The Private Mortgage Insurance Price Reduction Will Pull High Quality Borrowers From Fha Urban Institute

New Bill Aims To End Fha Mortgage Insurance Premiums For Life Policy

Fha Mortgage Insurance What You Need To Know Nerdwallet

Fha Loan Mip Calculator Estimate Additional Loan Payment Costs Moneygeek

Fha Slashes Mortgage Insurance Premium How Much Will You Save California Mortgage Broker

Fha Mortgage Insurance Premiums In New Jersey Unchanged For 2019 Nj Lenders Corp

Fha To Reduce Monthly Mortgage Insurance Fha Mortgage Source